|

Tuition Information for Gospel

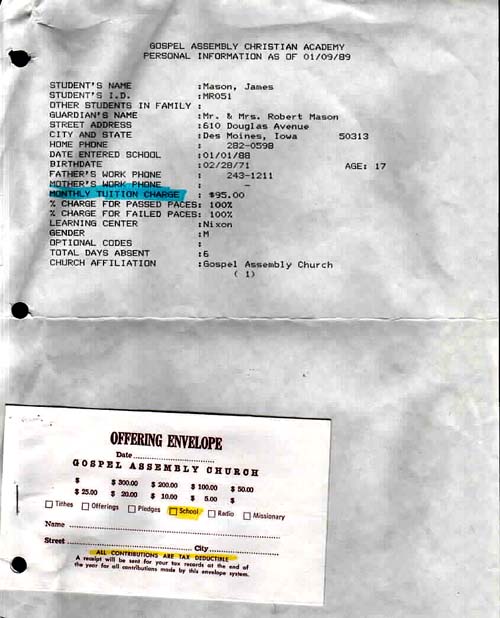

Assembly Christian Academy The document below is an invoice that was provided to Mr. & Mrs.

Robert Mason and lists the "monthly tuition charge" for their son

James. Lloyd L. Goodwin, from the school's inception, stated that the charge

was not tuition and that the monies provided to the school should be

claimed as a charitable donation on the parents' tax returns, so that the

parents could get more on their tax returns and give that money to the church

as well. Yet, Goodwin and Gospel Assembly set a specific amount that was to

be paid for each student attending the school. The offering envelope below

clearly indicates that any monies submitted through the "envelope

system" would be listed as tax-deductible. Parents paid their tuition

through the envelope system. Clearly, the Internal Revenue Service would be

fascinated to learn that tuition paid to private, parochial schools is

tax-deductible. Obviously, the Internal Revenue Service needs to update the

tax code. We hope this webpage will alert the IRS of the facts of this

situation. |